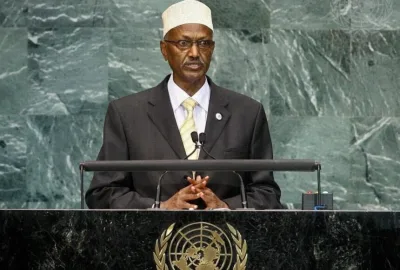

Somalia reached another significant milestone in its debt relief journey as Finance Minister Bihi Iman Cige and Danish Ambassador Steen Sonne Andersen signed a bilateral debt forgiveness agreement on Monday, eliminating Somalia’s 60 million Danish Krone ($8.5 million) debt to Denmark.

The agreement follows the March 2024 Paris Club decision to forgive Somalia’s debts, which required the Somali government to engage in individual negotiations with creditor nations. This latest development adds to Somalia’s recent debt relief successes, including agreements with the United States, which held the largest portion of Somalia’s debt, and Japan.

“The fruits of the financial reform program and the achievements of the debt relief process have come true,” said Finance Minister Bihi Ege after the signing ceremony. “We are grateful to the Government of Denmark, which is a valuable friend who is part of the financial development of Somalia.”

The debt forgiveness comes as part of the broader Heavily Indebted Poor Countries (HIPC) Initiative by the International Monetary Fund (IMF), which has facilitated the forgiveness of Somalia’s external debt exceeding $5 billion. The HIPC program specifically targets the world’s poorest countries struggling with unsustainable debt burdens.

Beyond debt relief, Denmark continues to demonstrate its commitment to Somalia’s development through a new $18 million aid package spread over four years. This assistance will focus on “strengthening livelihoods and self-reliance, preventing and dealing with displacement in Somalia,” establishing Denmark as one of Somalia’s key development partners.

This agreement marks another step forward in Somalia’s economic reconstruction efforts and its reintegration into the international financial system. The country’s successful engagement with the Paris Club and bilateral creditors reflects the government’s commitment to financial reforms and economic stability.

HORSEED MEDIA