Remittances are a lifeline to many in Somalia and elsewhere in Africa, but how do financial…

Remittances are a lifeline to many in Somalia and elsewhere in Africa, but how do financial firms operate in such risky areas?

When Sir Paul Collier made reference to a “bottom billion” he shone a much-needed light on a group of small nations largely unnoticed by the west. He argued a bold new plan was required to support these nations.

Structuring remittance finance to help sustain and drive development in such emerging and frontier markets should be one of the core policy agendas for a number of international governments.

The transfer of money by expat communities to their families and local communities back home provides a vital lifeline for many of Africa’s more remote regions. To put into context the size and importance of the market, approximately £24bn is sent annually to Africa by its diaspora. For the region as a whole, this is 50% more than net official development assistance. In Somalia, remittances are estimated to account for 50% of its gross national income.

Millions of Somalis – 40% of the population – rely on remittances to support their livelihoods, including paying for food, medicine and education. Remittances provide not only humanitarian support, but contribute to long-term economic development and stability, including the ability to develop, in due course, formal financial systems operating to international standards.

There has been much discourse in political corridors about the role of remittances in fuelling economic growth. This was prompted most recently by the African Development Bank’s projections that African economies are likely to expand by an average of 4.8% in 2014 from 3.9% last year, rising to 5.7% in 2015, when at face value even Africa’s larger economies, such as Ghana and South Africa, are under pressure.

The ADB’s projections have led some to question Africa’s levels of organic growth (as opposed to externally driven growth) given that the majority of African countries, particularly communities in the more rural areas, are still heavily reliant on diaspora finance and external aid.

At Dahabshiil Group, we witness, at close quarters, the significant positive impact that remittances can make in not only supporting livelihoods, but underpinning economies.

As an indigenous African company, Dahabshiil operates across a number of developing regions and serves dislocated communities often affected by war, famine and severe poverty. Somalia, a core market, has been wracked by civil war, insurgency and piracy for over two decades. While the country’s overall security has improved in recent years, certain regions still require the presence of aid agencies and proactive military forces to arrest humanitarian crises and ensure public safety.

Operating in conflict zones raises serious operational considerations for any organisation, but it is particularly challenging for businesses in the financial services sector, including banks. International banks have no presence in Somalia. Therefore money service businesses (MSBs) are the only safe and transparent way to send money into the country. As MSBs are intensive cash-handling businesses, they require rigorous risk-mitigation procedures to protect against the vulnerability of facilitating illicit financial flows – which is ever more important in high-risk territories.

It is vital to be very aware of the pitfalls of operating in conflict zones and other such territories. A key procedure is to apply strong “know your customer” and transaction monitoring policies across all areas of operation, often in excess of legal minimum requirements. These policies should be kept under constant review and all stages of the remittance process should be examined to ensure that risk assessments are well-founded, using information from all credible sources, including law enforcement.

Controls, such as enhanced due diligence for higher-risk customers and transactions; central compliance clearance for transactions of particular types and size; and automatic screening against sanctions-list-using IT systems, protect us as far as possible from abuse by criminal elements.

Due to the risks presented in some of the territories in which we operate and the challenges posed by lack of infrastructure, we impose our own policies for anti-money laundering and combating the financing of terrorism.

Standard methods of knowing your customer sometimes cannot always be applied. In such cases, we use our extensive knowledge of the local communities for assurance that individuals are adequately identified through other acceptable means. The use of a common IT platform across our operations ensures transparency and visibility of transactions to all compliance functions in Dahabshiil operations, so that remittances are not paid unless they are approved at both ends. It also allows us to co-operate efficiently with the authorities as required by law.

The biggest challenge for the MSB sector is adapting and responding to the global banking de-risking agenda, which is threatening the development and recovery in emerging economies and post-conflict states around the world. Indeed, for Somalia to continue its progress towards political, humanitarian and economic stability it is vital to build a self-sustaining economy – remittances, at an affordable cost, form a crucial part of that process.

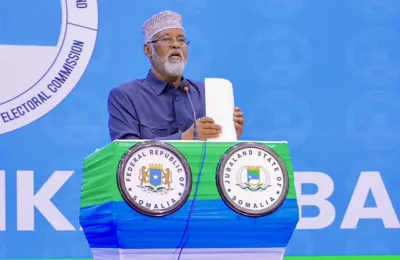

Abdirashid Duale is chief executive of Dahabshiil Group